”The Russian invasion of Ukraine reminds us that agriculture and agricultural policy have global and geostrategic dimensions.

Prof. Dr. Stephan von Cramon-TaubadelDepartment für Agrarökonomie und Rurale Entwicklung *1.

15.03.2022. You will find a addendum at the end of the article.

Key messages:

- The Russian invasion of Ukraine will have immense consequences for millions of Ukrainians, for security in Europe, and for energy markets, but also for agricultural markets and global food security.

- Ukrainian grain production and exports will likely fall by at least 35 million tons compared with 2021. In addition, damage to infrastructure such as harbour facilities will make it difficult to export any surpluses that are produced. Russian production will most likely not be affected, but logistic and financial restrictions will delay, re-route, and possibly reduce Russian grain exports.

- In anticipation of these effects, global grain prices have jumped to historical highs. Unless the hostilities end and Russian troops withdraw immediately, there is little relief in sight. Global grain markets were tight before the invasion took place, and will remain so, possibly for years to come.

- Reduced grain exports from the Black Sea region pose no threat to food security in high-income countries such as Germany. Food price inflation will increase, but most households can cope, and targeted social assistance can be provided to low-income households that cannot.

- However, the situation in low-income, import-dependent countries is dire. Hunger was on the rise again before the Russian invasion of Ukraine; increased shortages of grain and high prices threaten the food security of hundreds of millions, especially in Africa and Southeast Asia.

- The Russian dictator will attempt to use the ‘food weapon’ to discredit and sow discord in the West. He hopes that a resurgence of migration fuelled by food insecurity and instability in Africa and the Middle-East will weaken the EU’s solidarity and resolve. He will blame the West for growing hunger and food insecurity – he will argue that Russia has grain and would like to help, but cannot do so because of economic and financial sanctions.

- In response to the emerging challenges, policy makers in the EU should:

– Contribute to the preparation and funding of a large-scale, internationally coordinated food assistance and food aid response.

– Resist the temptation to implement ‘selfish’, pro-cyclical policies (such as the wheat export ban recently announced by Hungary) that export hunger to the poorest of the poor.

– Rethink EU agricultural policy. The Russian invasion of Ukraine forces us to acknowledge that agricultural policy also has a geostrategic dimension – it is not just about satisfying the desire for a cosy, picture-book version of agriculture close to home. This means implementing policies that make all of agriculture in the EU more sustainable and productive, rather than increasing sustainability at the expense of productivity.

– Rethink biofuels policy. The Russian invasion has highlighted need to reduce dependence on fossil fuels for geostrategic as well as environmental reasons. Biofuels could contribute to reducing dependence. But when biofuels are produced on land that could otherwise produce food, they make food scarcer and more expensive. Policy makers should consider eliminating or relaxing mandates that require energy suppliers to use biofuels without regard to price.

The Russian invasion of Ukraine in late February 2022 marks the beginning of a new phase in history. For the first time since September 1939, a dictator has invaded a neighbouring country in Europe. It has been a rude awakening for many, especially in Germany, who clung far too long to delusions about the Russian dictator’s motives and the lengths to which he is willing to go in pursuit of them. If the invasion does not proceed as the dictator planned, and there are indications that this is the case, we can only pray that he does not or is not permitted to go to the ultimate lengths at his disposal. The military outcome of the invasion is unclear, but it is clear that it will have immense and lasting implications for politics, economics and business in the coming years and beyond. Public discourse in Germany has so far focussed mainly on military issues such as the delivery of weapons, on economic and financial sanctions, and on energy markets. In the coming weeks attention will shift to the provision of humanitarian aid to millions of refugees and displaced persons in Ukraine. While all of these interrelated issues are undeniably crucial, the Russian invasion of Ukraine also has far-reaching and extremely threatening implications for agricultural markets and food security. In the following we discuss these implications. Some short-run and local effects of the invasion on agricultural markets are manifest; other longer-term and global effects will depend on how the military conflict unfolds and on individual and collective policy reactions in other countries.

Background

20 years ago, the agricultural implications of a military conflict between Russia and Ukraine would have been severe for those countries, but of little global consequence. Between 1992 and 2002, Ukraine, Kazakhstan and Russia (UKR) combined for average annual net exports of 3 million tons of grain *2 – a negligible amount. Between 2012 and 2021, however, their net exports averaged 87 million tons per year, and they have exceeded 100 million tons in each of the last five years (Figure 1).

In the last completed grain marketing year (2020/21), UKR exported 102 million tons of grain, mainly wheat, corn and some barley, which is 24% of total global exports of 434 million tons (Figure 2). The United States Department of Agriculture’s (USDA) most recent projection for the current marketing year (2021/22) foresees UKR’s grain exports increasing to 115 million tons (25% of total global exports), with Ukraine’s grain exports increasing especially strongly to 64 million tons or 14% of the world total. However, these projections were released on February 9, 2022, before Russia invaded Ukraine. The invasion will affect exports in the remainder of the 2021/22 marketing year. The rapid growth in UKR grain exports is the result of a major turn-around in grain markets in the Former Soviet Union. Beginning in the 1970s the Soviet Union became one of the world’s largest net importers of grain as its centrally-planned agriculture foundered in inefficiency. However, the region has immense agricultural potential. Ukraine and Southwestern Russia together account for a large share of the world’s best, so-called black soils that are ideally suited to producing grain. In addition, there are comparatively low-yielding but vast tracts of cropland in Central Russia as well as Northern

Kazakhstan and the bordering regions of Russian Siberia.

Following the onset of transition in the early 1990s grain production in UKR fell by roughly half as centrally-planned agriculture imploded. At the same time, however, the demand for feed grain also collapsed as heavy Soviet subsidies for livestock production (milk, meat and eggs) ceased. After bottoming out around the turn of the century, grain production began to recover, slowly at first, and more rapidly in recent years. Yield increases have been largely driven by imported technology in the form of farm machinery, crop varieties and agronomic know-how. Since 2015, UKR grain production has consistently topped the highest (likely exaggerated) levels reported in Soviet times. Livestock production has also recovered somewhat, thus increasing domestic demand for grain. But the feed efficiency of milk, meat and egg production is vastly improved compared with Soviet times. The transformation of UKR agriculture coupled with investments in storage and transportation infrastructure (especially port facilities) has enabled the region to generate substantial and growing export surpluses over the last decade (Figure 1). Looking back, one might say that the agricultural potential of one of the most fertile regions of the world is finally being tapped, after decades of Soviet mismanagement and subsequent restructuring.

Increased production has allowed UKR to capture and maintain a constant share of an ever-growing of global grain market. Since the middle of the last decade, UKR have accounted for roughly 25% of global grain trade, plus-minus annual fluctuations of 1-2 percentage points. As a result, the Black Sea region has become a focal point of global agricultural price determination. Traders and market analysts continue to monitor weather conditions, crops, and movements of grain in the major exporting countries in North and South America (Argentina, Canada and the US) and Western Europe (especially France and Germany). But conditions in the Black Sea region also command their attention, and this has reduced the US’s traditional leadership role on markets for wheat and other grains *3. It is no exaggeration to say that the emergence of UKR as major grain exporters has reshaped global food markets. As a result, the invasion of Ukraine will have dire consequences, not only for millions of Ukrainians, but also for food security in countries around the world.

In the following we first consider the short-term effects of the Russian invasion that will unfold in the remaining weeks and months of the current 2021/22 marketing year and, more importantly, affect production in 2022 and exports in the 2022/23 marketing year. We then discuss longer-term effects that will be felt in subsequent years.

Short-term effects of Russia’s invasion

Ukrainian production and exports

In the black soil regions of Ukraine and Russia, winter wheat was planted last fall; wheat acreage and potential production are therefore largely fixed. By all reports, the weather has been good in Russia so far, and somewhat too dry in Ukraine. Overall, the crops are emerging in good condition as winter departs. However, amid anecdotal evidence of men leaving and farms donating their fuel stocks to support the defence effort, the invasion will severely affect farm operations in Ukraine. Farms will be unable to make fertiliser applications that usually take place in March/April. Hence, even if the wheat crop can be harvested and processed, yield reductions of about one-third appear inevitable. Furthermore, we expect the quality of the wheat to be lower, as a reduced nitrogen fertilizer application leads to lower protein content.

In addition, a large share of Ukraine’s best cropland is located in eastern and southern Oblasts (provinces) that overlap with what Russian nationalists refer to as ‘Novorossiya’. Armed conflict and Russian attempts to annex this part of Ukraine could severely hamper efforts to harvest a crop there. Finally, all of Ukraine’s harbour cities (such as Odessa and the Odessa port range, Mykolayiv, Kherson and Mariupol) are located in these Oblasts along the Sea of Azov and the Black Sea coast from the Crimea to Transnistria. Some of these cities (e.g. Kherson, Mariupol) have seen heavy fighting. Hence, it is likely that grain terminals and rail connections there have been damaged. In addition, there are reports that harbour entrances and waterways have been mined, which could hinder export flows in this and in subsequent years.

The situation for spring crops, especially corn and some spring barley, is worse. These crops have yet to be planted. Soil preparation and seeding of spring barley would usually begin around now (early March) in southern parts of Ukraine and move gradually north in the coming weeks. The single most important crop in Ukraine is corn, which is planted from early April into mid-May. Seed, especially hybrid corn, fuel, labour – all essential inputs are missing, or it is currently impossible to bring them to the right places at the right times. It is therefore highly unlikely that Ukraine will be able to harvest anywhere near the 42 million tons of corn that it harvested in 2021.

In summary, it is unclear how much grain Ukraine will be able to produce and harvest in 2022, and whether it will be able to export what is harvested in the upcoming 2022/23 marketing year. An optimistic scenario would foresee projected wheat exports reduced by one-third from 2021 levels, from 24 to 16 million tons, and coarse grain (largely corn) exports reduced by two-thirds, from 40 to 13 million tons. In this case, Ukraine would export 29 million tons in 2022/23, compared with 64 million tons in 2021/22, a shortfall of 35 million tons. We stress, however, that this is a first, optimistic guess. The longer the conflict lasts, the more crops and grain export infrastructure will suffer, and the larger the production and export shortfalls will be.

Russian production and exports

Russian production will be less affected. Record high grain prices in US-Dollars or Euro coupled with a plummeting Rubel will provide farmers with powerful incentives to produce, if the logistics of the invasion (moving troops, equipment and supplies) do not interfere with supplies of seed, fertiliser and fuel in Russia’s main producing regions that border on Ukraine. If sanctions reduce Russian (and Belarussian) exports of potash fertiliser, its prices on the domestic market might even fall. Furthermore, the Russian government will likely take steps to ensure that key inputs do not leave the country – in the first week of March, for example, it ‘recommended’ that fertiliser producers stop exporting nitrogen fertiliser. Overall there is little reason to expect that Russia will harvest substantially less grain than it did in 2021.

However, it is much less certain that Russia will be able to bring all of this grain to the world market via its Black Sea ports. As a result of the invasion, access to the Sea of Azov has been cut off. For the moment, therefore, grain cannot flow from Russia’s second most important export harbour in Rostov-on-Don (and from Ukrainian harbours on the Sea of Azov such as Mariupol). Grain export volumes from the Black Sea region are always at a seasonal low at this time of year, so the immediate effects of reduced shipping through the Sea of Azov are not dramatic. However, if restrictions continue into June, when this year’s harvest begins, and beyond, then Russian export flows will be disrupted. Furthermore, even if exports at this time of year are usually relatively low, they are nevertheless important because they empty grain terminals and storage facilities farther inland and thus make space for the approaching harvest. The current stoppage of exports could lead to a backlog of grain, insufficient storage capacity when the harvest starts in June and, ultimately, waste and quality losses.

It is also possible that Russian shipping could face restriction on passage through the Bosporus. In any event, ship owners will be hesitant to send ships into the Black Sea, and in a situation fraught with the risk of force majeur, insurance for ships and cargoes is either unavailable or extremely expensive.

In addition to physical bottlenecks, financial sanctions will also reduce Russian exports. The exclusion of most Russian Banks from the international payments system SWIFT will make it much harder for international trading companies, which handle a large part of Russia’s grain exports, to purchase grain from Russian suppliers. As of March 1st, the requirement that exporters exchange 80% of their earnings into (increasingly worthless) Rubel will add to the costs of trade for Russian grain.

Russia could attempt to circumvent some of these physical and financial restrictions by re-routing its grain exports to countries that have not joined the sanctions, for example via the Caspian Sea to Iran and Central Asia, or via rail to China. However, these alternative routes cannot handle anywhere near the volumes that Russia’s Black Sea ports such as Rostov-on-Don and Novorossiysk can. Russian exporters might also turn to barter deals with importing countries to bypass financial restrictions, but barter is a comparatively clumsy and costly mode of trade – not all countries that wish to import Russian grain will be able to offer equivalent volumes (in value terms) of goods that Russia wishes to import in return. Hence, even if Russian grain production is not affected, the timing, efficiency, and to some extent the volume of Russian grain exports will be.

Implications

The above considerations suggest a best-case scenario in which Ukraine could produce and export 35 million tons less than projected this year, while the Russian harvest proceeds more or less as projected but at least some of its grain exports are delayed and re-routed.

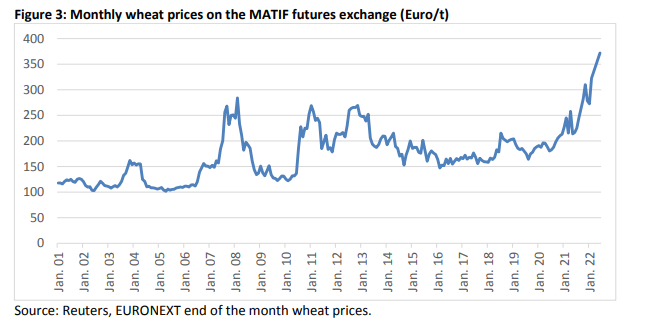

At first glance this scenario might appear manageable. 35 million tons are only 7.6% of total projected global grain exports of 460 million tons in 2021/22. On some markets a shortfall of 7.6% might not be grounds for concern. However global demand for grain, as food for humans and feed for animals, is what economists refer to as ‘inelastic’, meaning that small shifts in availability trigger large swings in prices. People must eat, and grains such as wheat are staple foods. If grain is in short supply, people (or governments) will attempt to maintain their consumption by reducing other, lessessential expenditures and channelling more of their purchasing power into buying grain. More purchasing power concentrated on less supply inevitably translates into higher prices. Global grain markets have responded with prices well above 300 Euro/ton in recent months, even higher than the prices seen during the so-called ‘food price crisis’ of 2007/08 (Figure 3). Current futures prices for months after the upcoming harvest in the northern hemisphere (September and December contracts) are lower than this, but still above 300 Euro/ton.

In high-income countries such as Germany, price increases for grain will contribute to food price inflation. Since low-income households spend higher proportions of their income on food, they are disproportionately affected by food price inflation. Hence, it is likely that the governments of many high-income countries will respond by implementing social policy measures such an increased welfare payments and minimum cost-of-living allowances. However, the Russian invasion of Ukraine does not pose any fundamental threat to food security in high-income countries. The EU is a net exporter of most staple foods such as wheat, and it has more than enough purchasing power to ensure sufficient domestic supply. On average, households in Germany spend only about 14-15% of their income on food (including beverages and tobacco) and are thus able to adjust to food price inflation.

Furthermore, it would be wrong to blame food price inflation on increasing in grain and other agricultural commodity prices alone. In Germany roughly 22% of consumer expenditure on food ends up in farmers’ pockets; the other 78% pay for processing and marketing costs (transportation, storage, packaging etc.). The farm share of consumer expenditure on food varies from product to product and is generally higher for animal products (such as milk and eggs) and lower for plant products. For bread, the farm share of consumer expenditure, at 4-5% in Germany, is especially low. In other words, 95-96% of the price of bread are payments not to farmers but to traders, millers, bakers and retailers, and the capital, energy and labour that they employ to transform grain on the farm to bread on our tables. Yes, food prices are increasing because agricultural commodity prices are increasing. But processing and marketing costs, especially for energy and labour are also increasing. Targeted social policy measures are an efficient response to the challenge of food price inflation; governments should avoid any temptation to intervene directly on agricultural or food product markets. We discuss broader implication for EU agricultural policy below.

The situation in low-income countries is entirely different. Food price inflation poses an existential threat to the health and survival of hundreds of millions of individuals in these countries. Households that already spend 50% and more of their income on food have little scope to reduce other types of expenditure when food prices increase, and that ‘other’ expenditure is generally for other essentials such as housing, health care and education. In addition, compared with high-income countries, the farm share of consumer expenditure on food is much higher in low-income countries, because the food products that consumers purchase are typically less processed. Hence, increases in agricultural commodity prices hit consumers in low-income countries harder.

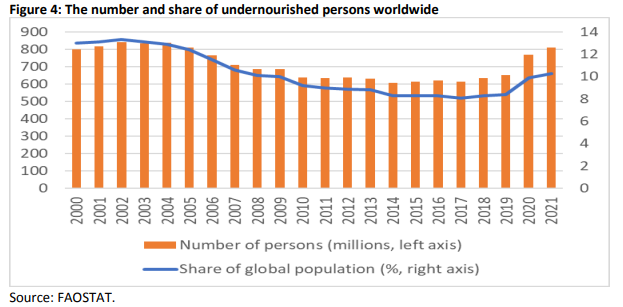

The global food security situation was already dire before Russia invaded Ukraine. After years of frustratingly slow but nonetheless steady reductions in both the number and the share of undernourished people worldwide, progress had slowed and halted in the mid-2010s, and reversed in 2020 and 2021 primarily due to COVID-19 (Figure 4). Between 2017 and 2021, the number of undernourished persons worldwide increased by 200 million. Russia’s invasion of Ukraine pours oil on that growing fire and threatens to trigger a global catastrophe.

At the same time as hunger and food insecurity been on the rise again in recent years, the situation on international grain markets has become increasingly precarious. Stocks play an important role on commodity markets, and global grain stocks are currently at near historically low levels. The USDA estimates that there were global wheat stocks of 290 million tons at the end of the 2020/21 marketing year, and global coarse grains stocks of 321 million tons. At first glance, 611 million tons of stocks might appear to be more than enough to compensate for a shortfall of perhaps 35 million tons in Ukrainian and Russian exports. However, 290 million tons of wheat is only 37% of global wheat consumption in 2020/21, in other words enough to cover slightly more than 4 months global wheat use. Coarse grain stocks would only suffice to cover roughly 3 months of global use. In addition, less than half of the estimated global stocks are held outside China (146 million tons of wheat and 114 million tons of coarse grains in 2020/21). China is very secretive about its stocks. USDA stock estimates are the best that we have, but nonetheless very uncertain. Moreover, it is unclear whether and under what conditions China might be willing to make grain from its stocks available *4.

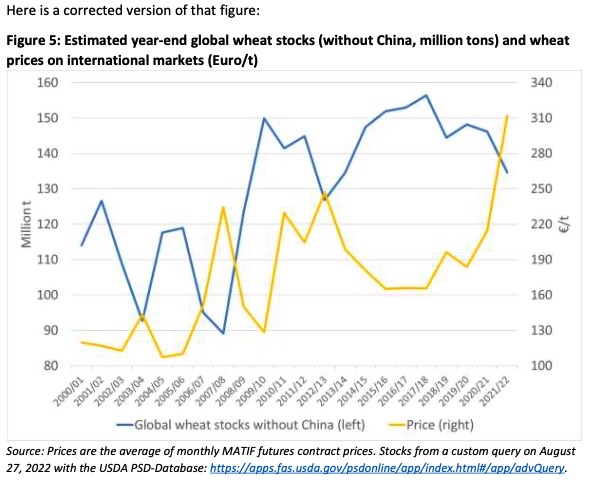

Finally, global grain stocks are not pure reserves like the pasta and UHT milk that one stores at the back of the pantry ‘just in case’. Global grain stocks are largely working stocks that fill the pipeline between the farm and the fork. Stocks are held on farms, in country elevators, and at grain terminals in importing and exporting harbours. A certain amount of grain is needed to keep the pipeline full and flowing until the next harvest begins to arrive in volume, and markets get very nervous when stocks fall close to this amount and flows start to stutter. As shown in Figure 5, there is a strong negative correlation between wheat stock levels and wheat prices – when stocks fall, prices rise.

Correction (03.10.2022)

In the paper “Russia’s invasion of Ukraine – implications for grain markets and food security” that was posted on March 7, 2022, I included a Figure 5 which shows how global wheat stocks and world market wheat price levels have evolved over the last 20 years. I made an error putting together that figure – the line depicting global wheat stocks in the major exporting countries is wrong.

The basic message – that there is a strong negative correlation between global stocks and price levels – remains unchanged. Global stocks have tended to increase over the last 20 years in absolute term. However, production and consumption have increased as well, so stocks as a share of annual use have not trended upwards the way that absolute stock levels have. I should stress that stock levels are estimated, and there is a much uncertainty about their actual levels.

When I put together the original Figure 5 I mixed up several series of numbers on wheat and grain stocks in different countries. This was careless of me, and I apologise for any confusion or inconvenience. I am very grateful to Martin Banse for pointing out the error.

In addition, when grain prices rise they also tend to become more volatile, meaning that day-to-day and intra-day fluctuations become larger. When supply is low and market participants are worried, new information and rumours, (for example, reports on March 4th that a nuclear power plant in Ukraine been attacked and damaged by Russian troops) can cause prices to suddenly skyrocket. In the months of January and February 2020, the average day-to-day wheat price change on the MATIF futures market was 0.68 Euro/ton. This average day-to-day price change increased to 1.21 Euro/ton in the first two months of 2021, and to 5.37 Euro/t in the first two months of 2022. Volatile prices make markets riskier and thus increase the costs of making a wrong decision, or a right decision at the wrong time. Traders are directly affected by these increased costs, but ultimately risk premia are passed on to other market participants such as farmers and consumers.

Production and export shortfalls caused by the Russian invasion of Ukraine threaten to reduce global stocks and further boost prices and volatility *5. This can trigger a vicious circle as importing countries hurry to secure supplies (for example by reducing their import tariffs) and exporting countries impose export restrictions in an attempt to keep domestic supply high and domestic prices low. Such responses are individually rational but collectively counterproductive because they are pro-cyclical – countries attempt to shield themselves from higher prices with measures that drive prices even higher. Following the 2007/08 food price crisis it was estimated that such ‘selfish’ national policy responses caused as much as 45% and 30% of the price hikes for rice and wheat, respectively, that occurred at that time *6. Since Russia’s invasion of Ukraine began, reports of similar measures (e.g. a wheat export ban announced by Hungary on March 4th, a new grain export levy in Argentina) have begun to accumulate.

The effects of the price hikes triggered by Russia’s invasion of Ukraine are already being felt in lowincome, import-dependent countries in the Middle East, Northern and Sub-Saharan Africa and Southeast Asia, such as Afghanistan, Egypt, Kenya, Bangladesh and Indonesia. 17% of the world’s food insecure population live in countries where wheat is the main food grain; a further 27% live in countries where corn is the main food grain *7. In recent weeks countries have seen the costs of importing wheat, corn and other grains increase by 50% and more compared with one year ago. The United Nations and various aid agencies are already sounding the alarm as the costs of providing food aid and food assistance skyrocket.

Long-term effects of Russia’s invasion

The long-term effects of Russia’s invasion are impossible to predict, because they depend on how soon and under what conditions the conflict is resolved.

In a pessimistic scenario, protracted conflict followed by a repressive Russian military occupation could lead to a massive exodus of human capital, and severely damage infrastructure and production capacities in Ukraine for many years to come. Perhaps Russia could eventually subdue Ukraine, bring Ukrainian production capacity under Russian control, and emerge as an even bigger player with a consolidated 25% share of world grain markets. However, while this might provide relief to world markets by restoring grain supply from the Black Sea region, it is unlikely to happen quickly. Moreover, and it would give the Russian dictator place even more power to manipulate grain markets and influence global food security. At the other, more optimistic extreme, rapid resolution of the conflict and Russian withdrawal from Ukrainian territory would allow for quick repair of (so far) limited damage to agricultural production capacities and export infrastructure. Under these circumstances, Ukrainian production and exports might return to pre-conflict levels within perhaps 2-3 years. Which path is taken, hopefully as close as possible to the optimistic extreme, will determine how much suffering both the Ukrainian people but also hundreds of millions of food insecure

individuals worldwide will have to endure in the coming years.

Even if a more optimistic scenario prevails, the situation on global grain markets will be extremely tense for the next 2-3 years at least. Humanity faces the daunting challenge of increasing food production while reducing agriculture’s environmental footprint. Doing so without making the best possible use of the Black Sea breadbasket, one of our planet’s most fertile regions, is like competing in a men’s eight rowing final with only seven men in the boat.

Policy responses

Beyond hoping for an immediate withdrawal of all Russian troops from Ukrainian territory, and bumper crops in the rest of the world, what can we do to limit the damage caused by the Russian invasion?

The Russian invasion of Ukraine reminds us that agriculture and agricultural policy have global and geostrategic dimensions. There are indications that many in Germany and the EU needed reminding. Recent agricultural policy proposals in Germany in particular have been largely inward looking, focussing on unilateral German initiatives to improve animal welfare, reduce local environmental impacts, and preserve small family farms. In these proposals (e.g. the so-called Borchert Commission proposals to improve animal welfare in Germany, or the proposals developed by the Zukunftskommission Landwirtschaft), international market linkages, both within the EU and with third countries, tend to be neglected, or viewed as an inconvenient obstacle on the way to achieving German objectives. Policy responses to the Russian invasion of Ukraine must explicitly recognise the opportunities and constraints implied by the integration of global agricultural markets.

a) Prepare a coordinated response to the looming global food security crisis

Global grain prices are high and will stay that way for the foreseeable future as markets adjust to the fact that considerably less grain than anticipated will be available following this year’s harvest, and probably for several years to come. This poses a huge challenge for many low-income, import dependent countries, for example in Africa and the Middle-East. In 2007/08, we saw that food price inflation can fuel unrest, destabilise countries, even topple governments.

A substantial, coordinated policy response to this looming crisis is imperative for humanitarian reasons. But it is also a question of pragmatic self-interest for Germany and the EU. There can be little doubt that the Russian dictator will attempt to use the ‘food weapon’ to sow division within the EU and the Western world. In several months, once the initial wave of solidarity for Ukrainian refugees has ebbed somewhat in the EU, a resurgence of migration across the Mediterranean fuelled

by food insecurity and instability in Africa and the Middle-East could quickly weaken the EU’s solidarity and resolve. The Russian dictator will be quick to blame the West for growing hunger and food insecurity – he will argue that Russia has grain and would like to help, but cannot do so because of economic and financial sanctions.

The international community needs to act immediately to prepare a coordinated response. This entails:

- Resisting all urges to implement ‘selfish’ pro-cyclical policy responses such as export bans that effectively export hunger to the poorest of the poor. High-income countries should soften the blow of food price inflation with social policy tools, and not with measures that make markets less efficient. Hungary’s recent announcement of a wheat export ban is a perfect example of the sort of ‘beggar thy neighbour’ reflex that must be avoided.

- Providing low-income countries with the financial means to purchase grain and target assistance. In some parts of the world, emergency, in-kind food aid will remain essential. Nevertheless, the shift to cash-based food assistance should be supported wherever possible. Since grain prices are high, the costs of ramping up food aid and food assistance will be high as well, and high-income countries will have to ramp up their efforts accordingly.

b) Rethink the EU’s Common Agricultural Policy

In recent years the main focus in agricultural policy debates in the EU has been on measures that will inevitably reduce crop production. As part of the most recent Common Agricultural Policy (CAP), the EU has decided to implement set-aside on 4% of its crop land. Germany plans to increase this to 6%. As part of its Green Deal Farm-to-Fork proposals released in May 2020, the EU Commission has suggested increasing the share of EU agricultural area that if farmed organically to 25%, and reducing the use of pesticides and herbicides by 50%, both by 2030.

While the goal of increasing the sustainability of agricultural production in the EU is undisputed, these proposals, especially the latter two, are questionable, especially in light of the new situation caused by Russia’s invasion of Ukraine. Global grain production will have to increase in the coming decades, not decrease, especially since the Black Sea region has become, at least temporarily, an unreliable supplier. The EU does not have as much prime black soil as Ukraine and Russia, but in comparison with much of the rest of the world it nevertheless boasts excellent conditions for crop production, comparatively reliable precipitation and temperatures, highly efficient, technologically advanced farms, and excellent infrastructure. Converting 25% of the EU’s farmland from conventional to organic production will reduce average yields on that area by one-third and more. Reducing pesticide use by 50% in eight years will also reduce yields. In a world that will be

desperately short of grain in the near future and perhaps for years to come, that would be irresponsible.

Grain production in the EU-27 has already been trending slightly downward, from an average of 296 million tons in 2013-15 to 286 million tons in 2018-2020. Further reductions in EU production will only contribute to continued global scarcity and high prices. These in turn would give farmers elsewhere in the world incentives to produce grain with greater intensity on more land. When these land-use changes are accounted for, measures that reduce the environmental costs of production here in the EU could very well end up increasing global environmental costs, for example in the form of greenhouse gas emissions *8.

Hence, with prices at record highs in the wake of Russia’s invasion, the EU needs to rethink the complex trade-offs between global hunger on the one hand, and local and global environmental effects on the other. The Russian invasion forces us to acknowledge that agricultural policy also has a geostrategic dimension – it is not just about satisfying the desire for a cosy, picture-book version of agriculture close to home. This means implementing policies that make all of agriculture in the EU more sustainable and productive rather than expanding a niche that may appear more sustainable from a local perspective, but at the cost of increasing hunger and environmental damage elsewhere in the world.

This also means rethinking policies such as the complete ban on glyphosate that is scheduled to come into effect in December 2022 in the EU. Such policies may satisfy activists, but they are the antithesis of rational, evidence-based policy that weights costs and benefits, as are neo-Luddite positions on CRISPR-Cas breeding technologies. In the medium and long term, continued innovation is the key to increasing the productivity and sustainability of agriculture, and its resilience to shocks

such as Russia’s invasion of Ukraine.

c) Rethink biofuels policy

The effects of the Russian invasion of Ukraine on global grain markets and hunger, but also on energy markets and security, will rekindle the food vs. fuel debates that last reached a head during the 2007/08 ‘food price crisis’. Here too, policy makers will need to reconsider complex trade-offs between competing goals. On the one hand, the Russian invasion has highlighted need to reduce dependence on fossil fuels for geostrategic in addition to environmental reasons. Biofuels are an alternative to fossil fuels that could contribute to reducing dependence. But when biofuels are produced on land that could otherwise produce food, maintaining or increasing their production makes food scarcer and more expensive.

In the US but also the EU, grain is used to produce ethanol. In the EU and the US, but also in Asia and South America, edible oils such as rapeseed and palm oil are used to produce biodiesel. The EU is a leader in biogas production, a substantial share of which takes place on small-scale, farm-based biogas plants in Germany and several other member states. Not all of this biofuel production competes with food production, but some of it does (for example the roughly 1 million hectares or

36% of the corn production area in Germany that produces corn silage for biogas production *9).

There are no easy, win-win solutions to the food vs. fuel dilemma, especially when it is overlaid with geostrategic considerations. But in the current situation there is a danger that preoccupation with the implications of the Russian invasion of Ukraine for energy policy could lead policy makers to neglect implications for food policy. Certainly, mandates that require energy suppliers to used fixed amounts or shares of biofuels should be reconsidered, perhaps softened. Fixed mandates mean that

energy suppliers cannot adjust when prices change. They make the demand for agricultural commodities even more inelastic that it already is, and this means that negative supply shocks, like the one we are currently facing, lead to even higher price peaks. One possibility would be to make mandates a decreasing function of grain or edible oil prices, so that energy suppliers would be required to use less biofuels when food prices are high.

Russlands Invasion in die Ukraine – Auswirkungen auf die Getreidemärkte und die Ernährungssicherheit:

- Die russische Invasion in die Ukraine wird enorme Konsequenzen für Millionen von Ukrainer*innen, die Sicherheit in Europa, die Energiemärkte, aber auch für die Agrarmärkte und die globale Ernährungssicherheit haben.

- Die ukrainische Getreideproduktion wird in diesem Jahr vermutlich um mindestens 35 Mio. Tonnen gegenüber 2021 sinken – eine Menge die folglich auch nicht exportiert werden kann. Darüber hinaus werden Schäden an der Infrastruktur wie den Hafenanlagen einen möglichen Export von Produktionsüberschüssen behindern. Russlands Produktion wird zwar aller Voraussicht nach nicht betroffen sein, doch logistische und finanzielle Sanktionen werden zu Verzögerungen und Handelsumlenkungen führen, wodurch es möglicherweise auch zu einer Reduktion der russischen Getreideexportmenge kommt.

- In Erwartung dieser Effekte haben die Weltmarktpreise für Getreide historische Höchststände erreicht. Sofern die Kriegshandlungen nicht beendet werden und sich die russischen Truppen nicht unverzüglich zurückziehen, ist kaum ein Preisrückgang in Sicht. Die Weltgetreidemärkte waren ohnehin schon vor der Invasion knapp versorgt und werden es auch voraussichtlich in den nächsten Jahren bleiben.

- Durch die geringe Getreideexportmenge aus der Schwarzmeerregion wird die Ernährungssicherheit in Industrieländern wie Deutschland zwar nicht gefährdet, aber die Inflation der Nahrungsmittelpreise wird dadurch angeheizt. Die meisten Haushalte werden das verkraften können und einkommensschwache Haushalte, die hiervon besonders betroffen sind, könnten mit zielgerichteter finanzieller Unterstützung zumindest entlastet werden.

- Allerdings ist die Situation in denjenigen Entwicklungsländern besonders katastrophal, die auf Nahrungsmittelimporte angewiesen sind. Die Zahl der unterernährten Menschen in diesen Ländern war schon vor dem Beginn der russischen Invasion in der Ukraine angestiegen und jetzt bedrohen Versorgungsengpässe und hohe Getreidepreise die Ernährungssicherheit von mehreren 100 Millionen Menschen, vor allem in Afrika und Südostasien.

- Es ist davon auszugehen, dass der russische Diktator die Problematik der globalen Ernährungssicherheit als Waffe nutzen wird, um den Westen in Verruf zu bringen und zu spalten. Er hofft, dass Flüchtlingsströme aus Afrika und Nahost durch Versorgungsengpässe und politische Instabilität erneut ansteigen werden, um so die Entschlossenheit und Solidarität der EU zu schwächen. Er wird den Westen beschuldigen, für zunehmenden Hunger und globale Versorgungsengpässe verantwortlich zu sein – gleichzeitig wird er betonen, dass Russland über Weizen verfüge und gern helfen würde, aber es wegen ökonomischer und finanzieller Sanktionen nicht könne.

- Als Antwort auf die sich abzeichnenden Herausforderungen, sollten die politischen Entscheidungsträger*innen in der EU…

… einen Beitrag zur Vorbereitung und Finanzierung einer groß angelegten, international koordinierten Nahrungsmittelhilfe leisten.

… der Versuchung widerstehen, vor allem im Eigeninteresse zu handeln und prozyklisch wirkende Politikmaßnahmen zu treffen (wie ein kürzlich durch Ungarn vorgeschlagenes Weizenexportverbot), wodurch die globale Hungerproblematik nur noch stärker auf die Ärmsten der Armen verlagert werden würde.

… die Gemeinsame Agrarpolitik der EU überdenken, denn die russische Invasion in die Ukraine zwingt dazu, die geopolitische Dimension der Agrarpolitik anzuerkennen – es geht nicht mehr darum, die Landwirtschaft von nebenan entsprechend den Vorstellungen eines idyllischen Bilderbuches zu gestalten. Agrarpolitische Maßnahmen müssen zunehmend darauf ausgerichtet werden, die Landwirtschaft der EU nachhaltiger und produktiver zugleich aufzustellen, anstatt die Nachhaltigkeit auf Kosten der Produktivität zu fördern.

… und die Bioenergiepolitik überdenken, denn die russische Invasion verdeutlicht die Notwendigkeit zur Senkung der Abhängigkeit von fossilen Energieträgern sowohl aus geostrategischen als auch aus umweltpolitischen Gründen. Bioenergie kann zwar zur Reduktion dieser Abhängigkeit beitragen, doch wenn die Bioenergieproduktion auf Flächen erfolgt, die ansonsten zur Erzeugung von Nahrungsmitteln verwendet werden können, werden Nahrungsmittel dadurch knapper und teurer. Politische Entscheidungsträger*innen sollten über die Abschaffung oder die Flexibilisierung von Verpflichtungen beraten, die unabhängig vom Nahrungsmittelpreisniveau eine Beimischung von Biokraftstoffen vorschreiben.

Footnotes:

*1 Please address correspondence to scramon@gwdg.de. I am grateful to Ludwig Striewe for critical comments and suggestions. All remaining errors are my own.

*2 In the following, ‘grain’ refers to wheat and the so-called coarse grains, which include corn, barley, rye, oats, triticale, sorghum and millet. We do not consider rice.

*3 See for example Janzen and Adjemian (2017): Estimating the location of world wheat price discovery. American Journal of Agricultural Economics 99(5): 1188-1207.

*4 It is striking that China, with 19% of the world’s population, is reported to have accumulated more than 60% of the world’s grain stocks.

*5 This will inevitably lead to accusations that speculators on futures markets are fuelling the crisis and profiting from increased hunger. Some of these accusations will appear on the same websites that would have us believe that Russia is currently liberating Ukraine from Nazi genocide. Honi soit qui mal y pense, but it would be

interesting to know how many of the Russian dictator’s cronies bought wheat and other grains futures in the days immediately preceding the invasion of Ukraine. The role of speculation on world grain markets was debated and analysed at length following the 2007/08 food price crisis; an overview and some evidence is provided by Aulerich, Irwin and Garcia (2013): Bubbles, Food Prices, and Speculation: Evidence from the CFTC’s daily Large Trader Data Files. NBER Working Paper 19065, Cambridge Mass.

*6 See Martin and Anderson (2011): Export Restrictions and Price Insulation during Commodity Price Booms. World Bank Policy Research Working Paper 5645, Washington DC.

*7 Sowell and Baquedano (2021): The importance of wheat in international food security. USDA Economic Research Service, Washington DC.

*8 A recent simulation exercise suggests that the Farm to Fork measures will have at best a very small effect on global greenhouse gas emissions, if land use change in the EU and abroad is accounted for. See Henning and Witze (2021): Ökonomische und Ökologische Auswirkungen des Green Deals in der Agrarwirtschaft, https://www.bio-pop.agrarpol.uni-kiel.de/de/f2f-studie/executive-summary-de.

*9 See FNR (2022): Maisanbau in Deutschland. https://mediathek.fnr.de/grafiken/daten-undfakten/bioenergie/biogas/maisanbau-in-deutschland.html.

15.03.2022 Addendum:

Since my paper “Russia’s invasion of Ukraine – implications for grain markets and food security” was released eight days ago on March 7, I have received a great deal of feedback – thank you very much to everyone who has taken the time to read and send me comments, encouragement and criticism. I would like to take this opportunity to respond to two issues that have come up in these exchanges.

First, I am very grateful to Alan Matthews for pointing out an error in the final section my paper where I refer to “rethinking policies such as the complete ban on glyphosate that is scheduled to come into effect in December 2022”. It is true that the current approval for glyphosate runs out on 15 December. However, it is possible that this approval will be renewed. The four Member State Assessment Group on Glyphosate (AGG) has concluded “that glyphosate does meet the approval criteria set in Regulation (EC) N° 1107/2009” (see https://ec.europa.eu/food/system/files/2021-06/pesticides_aas_agg_report_202106.pdf). The European Food Safety Authority (EFSA) and the European Chemicals Agency (ECHA) have yet to reach their final conclusions on the issue, and when they do, the Commission and its Standing Committee on Plants, Animals, Food and Feed (PAFF) must take a decision on whether to recommend renewal. There will be intense debate and lobbying on this decision as the December deadline approaches, and a complete ban is not a foregone conclusion.

Second, several individuals and organisations have criticised out that I did not mention reducing meat production as possible policy response to the Russian invasion of Ukraine. A press release by Foodwatch on March 11 summarises the main argument:

„Wenn die Agrarindustrie jetzt im Schatten von Putins Krieg gegen Umwelt- und Klimaschutz in der Landwirtschaft polemisiert, will sie vom Kernproblem ablenken: Die Zahl der Nutztiere muss drastisch runter! Ein Großteil der Landwirtschaftsfläche in Deutschland produziert nicht etwa Nahrungsmittel für Menschen, sondern Futter für die Tiermast. Hinzu kommen massenhaft Importe aus anderen Weltregionen, die alle in unsere Tierhaltung fließen – während sie vor Ort der Nahrungsproduktion Konkurrenz machen. Die Gleichung heißt: weniger Tiere gleich mehr Nahrungsmittelsicherheit.”

(“The agricultural industry is attempting to deflect attention from the core problem by polemising about environmental and climate protection in the wake of Putin’s war. The number of farm animals must be drastically reduced! A large share of the farmland in Germany is used to produce feed for animals rather than food for humans. In addition, Germany imports large quantities of animal feed from other parts of the world, where it competes with food production. The equation is simple: fewer animals equals more food security.” – author’s translation)

I agree that livestock production in an important part of the food security equation. However, I did not mention animal production and feed use in my original paper because I wanted to focus on things that policy makers can control directly and immediately. These are:

- Coordinated food aid and assistance;

- Avoiding pro-cyclical, beggar thy neighbour trade policies;

- Rethinking the implementation of production-reducing measures such as 4% set aside and 25% organic production; and

- Loosening or eliminating biofuels mandates.

Reducing animal numbers is different. Policy makers in Germany (or the EU) cannot directly control the number of livestock that are held. And even if they could, it is wrong to think that reducing the number of animals held in Germany (or the EU) would necessarily increase global food security – the equation is not as simple as Foodwatch would have us believe. As long as the global demand for livestock products remains unchanged, reductions in German or EU production would lead to increased prices and, thus, incentives for production elsewhere in the world. It is safe to assume that livestock production in other major livestock producing and exporting countries is on average less feed-efficient than in the EU. (It is probably, on average, less environmentally and animal friendly as well.) Hence, reducing livestock numbers in Germany would reduce feed use in Germany, but feed use elsewhere in the world would increase, perhaps by even more. Global food security would not benefit and might even suffer.

The key is not the supply of livestock products but rather the demand. Global food security would unequivocally benefit if Germans were to reduce their meat consumption. Every ton of pork that is no longer demanded means fewer pigs to fatten, less feed use, less manure to dispose of, and fewer docked tails. Note that if German pork consumption were to fall, German production would not necessarily fall by the same amount. Perhaps German pork production would remain unchanged, and the pork that Germans had formerly consumed would be exported instead. Or some of the reduction in German pork consumption would translate into reduced German imports of pork (such as Parma ham from Italy). Every ton of pork that is no longer demanded in Germany means fewer pigs to fatten and less feed use somewhere in the world; from the perspective of global food security it does not matter a great deal where. Ideally, the reductions in production would take place in countries where the feed-efficiency of livestock production and the animal welfare standards are lowest.

Could policy makers take steps to reduce meat consumption in Germany (or the EU as a whole)? Yes, they could tax meat production, a measure that has been widely discussed and researched in recent years. However, at a time when food price and general inflation are already at their highest levels in decades, and since increasing food prices burden lower-income households disproportionately, it is exceedingly unlikely that policy makers will take this step. This is why I did not mention reducing livestock production in my original paper. Livestock production is not the key; consumption is. And there are other policy responses available that will produce more substantial and immediate benefits for global food security.

That said, it certainly would be good for food security, the environment, animal welfare and their own health, if German consumers would voluntarily trim 10, 15 or 20 kg off their annual average consumption of meat.

Vielen Dank, Herr Professor von Cramon-Taubadel, für die kompakte Zusammenfassung der Situation und die Darstellung möglicher Konsequenzen für die Getreidemärkte und die Ernährungssicherheit. Welche Politikmaßnahmen schätzen Sie im Rahmen der GAP als am sinnvollsten ein, um gleichzeitig Produktivität und Nachhaltigkeit zu fördern?

Besten Dank. Zunächst unbedingt nationale Alleingänge wie zB den ungarischen Exportstopp unterbinden. Mittel- und langfristig Investitionen in Forschung und Ausbildung. Und weniger ‚Bio vs. Konventionell‘ in den Köpfen. Was ich in dem Beiteg nicht erwähne ist der Fleischkonsum – da könnten die Bürger der EU viel Beitragen (Umwelt und Marktentlastung).

Excellent article and summary Stephan. Thank you for it.

Thank you Kyosti!

Besten Dank. Zunächst unbedingt nationale Alleingänge wie zB den ungarischen Exportstopp unterbinden. Mittel- und langfristig Investitionen in Forschung und Ausbildung. Und weniger ‚Bio vs. Konventionell‘ in den Köpfen. Was ich in dem Beiteg nicht erwähne ist der Fleischkonsum – da könnten die Bürger der EU viel Beitragen (Umwelt und Marktentlastung).